HSA Employer Number of Payments Override

Maintenance > Human Resources > Benefits Administration > Benefit Plan Maintenance > HSA Category > Plan > Options

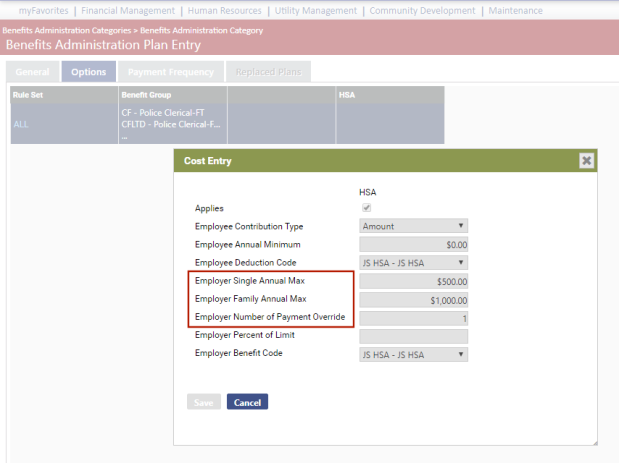

An Employer Number of Payments Override field has been added to the HSA Cost Entry dialog, and the Employer Single Amount and Employer Family Amount fields have been renamed Employer Single Annual Max and Employer Family Annual Max:

In the Employer Number of Payments Override field, select the number of payments the employer will make to an HSA to reach the annual maximum; for example, selecting 1 means the entire amount will be deposited in the HSA with the first check.

Fill in the Employer Single Annual Max field and the Employer Family Annual Max field with the total annual amount the employer will contribute for each coverage. That amount divided by the Employer Number of Payments Override is the amount that will be contributed each check; for example, if the Employer Family Annual Max is $1,000 and the Employer Number of Payments Override is 2, $500 is contributed with the first check and $500 with the second.

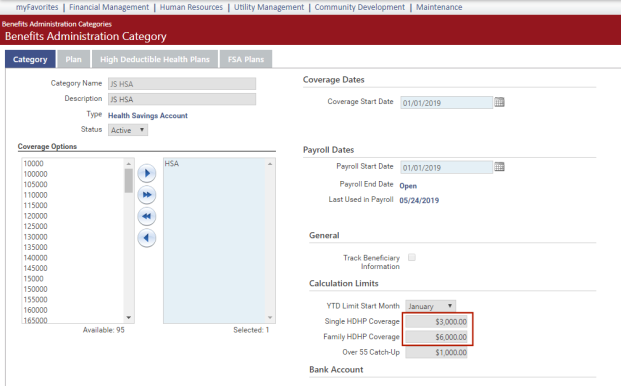

With this enhancement, the HSA benefit plan will allow for the employer's contribution to be made all at once, while the 26-pay cycle is maintained for employee contributions. The employer contributions on the Cost Entry page have now become annual maximum contributions for employers; as a result, separate plans no longer are required for employee and employer contributions when the frequencies differ, thus allowing the utilization of the annual plan maximum on the category page: